Basics for Employers

Here you will find

Basics for Employers

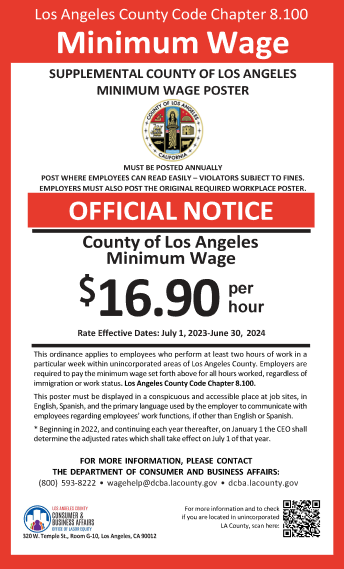

If you pay workers to do work in unincorporated Los Angeles County, here are some important details about the minimum wage, which is now $16.90 per hour as of July 1, 2023.

(Starting July 1, 2024, the minimum wage in unincorporated L.A. County increases to $17.27 per hour.)

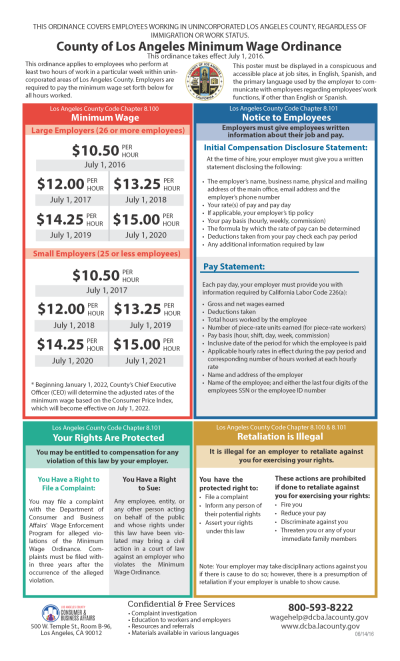

L.A. County Required Workplace Postings

Every Employer shall post both the primary Official Notice and the 2023 supplemental posting in a conspicuous place at any workplace or jobsite located within the unincorporated areas of the County where any Employee works. Employee Notification Requirements: Posting reproductions or facsimiles of DCBA’s Official Notice shall constitute compliance with the posting requirements of Los Angeles County Code Section 8.101.060 (A) where such reproductions or facsimiles are at least 8 1/2 inches by 14 inches, and the printing size is in at least 10 point font. Whenever the size of the DCBA’s Official Notice increases, the size of the print shall also increase accordingly.

What does the L.A. County minimum wage mean for employers?

Anyone who works at least two hours in a one-week period within the unincorporated areas of Los Angeles County is entitled to the County minimum wage for the hours worked in the unincorporated area of the County. The employee’s employment status, where they live, or where your business is headquartered does not determine the minimum wage that applies. Some of your workers may be exempt from this law. To determine if any of your workers are exempt, call us at 800.593.8222 or email us at wagehelp@dcba.lacounty.gov.

The County’s minimum wage will increase each year on July 1. Employers must pay their employees no less than the following hourly rates on the following effective dates.

| Year | For employers with 26 or more employees | For employers with 25 or fewer employees |

|---|---|---|

| 2016 | $10.50 | $10.00 |

| 2017 | $12.00 | $10.50 |

| 2018 | $13.25 | $12.00 |

| 2019 | $14.25 | $13.25 |

| 2020 | $15.00 | $14.25 |

| 2021 | $15.00 | $15.00 |

| 2022 | $15.96 | $15.96 |

| 2023 | $16.90 | $16.90 |

| 2024 | $17.27 | $17.27 |

To determine if work is done in an unincorporated area of L.A. County, enter the address at the County Registrar-Recorder’s website. (Follow our guide for step-by-step instructions.) You also can call DCBA. If your employees perform work in the unincorporated areas of L.A. County, even if your business or non-profit is not located in an unincorporated area of L.A. County, then you must pay them at least the County’s minimum wage. If your employee has not performed work in unincorporated L.A. County, you must pay the minimum wage established by the State of California or city where your business is located.

- Pay employees the minimum wage rate required by the County law for work performed in unincorporated L.A. County.

- Post a notice and the supplemental posting in a conspicuous place to inform employees of the current minimum wage rate and their rights under the law; or if you do not have a physical business location, provide a copy of the notice to all employees that perform work in the unincorporated areas of L.A. County. DCBA will make available the notice that you are required to post in the languages needed.

- Maintain accurate and complete payroll records for each employee for a period of four years.

DCBA works with employees and employers to ensure that violations of the County’s minimum wage law are identified, addressed, and remedied in a timely and effective manner. If DCBA receives a complaint about your business, we will contact you to check your payroll records and interview you and your employees. DCBA has the authority to issue a citation for any findings of a violation. DCBA will discuss the investigation with you and allow you to respond to any complaints and correct the situation, if necessary. It is against the law for you to retaliate against an employee who:

- Requests to be paid the mandated minimum wage.

- Files a complaint about a potential minimum wage violation.

- Informs other people about their rights or a potential violation.

What does the L.A. County minimum wage mean for employers?

Anyone who works at least two hours in a one-week period within the unincorporated areas of Los Angeles County is entitled to the County minimum wage for the hours worked in the unincorporated area of the County. The employee’s employment status, where they live, or where your business is headquartered does not determine the minimum wage that applies. Some of your workers may be exempt from this law. To determine if any of your workers are exempt, call us at 800.593.8222 or email us at wagehelp@dcba.lacounty.gov.

The County’s minimum wage will increase each year on July 1. Employers must pay their employees no less than the following hourly rates on the following effective dates.

| Year | For employers with 26 or more employees | For employers with 25 or fewer employees |

|---|---|---|

| 2016 | $10.50 | $10.00 |

| 2017 | $12.00 | $10.50 |

| 2018 | $13.25 | $12.00 |

| 2019 | $14.25 | $13.25 |

| 2020 | $15.00 | $14.25 |

| 2021 | $15.00 | $15.00 |

| 2022 | $15.96 | $15.96 |

| 2023 | $16.90 | $16.90 |

| 2024 | $17.27 | $17.27 |

To determine if work is done in an unincorporated area of L.A. County, enter the address at the County Registrar-Recorder’s website. (Follow our guide for step-by-step instructions.) You also can call DCBA. If your employees perform work in the unincorporated areas of L.A. County, even if your business or non-profit is not located in an unincorporated area of L.A. County, then you must pay them at least the County’s minimum wage. If your employee has not performed work in unincorporated L.A. County, you must pay the minimum wage established by the State of California or city where your business is located.

- Pay employees the minimum wage rate required by the County law for work performed in unincorporated L.A. County.

- Post a notice and the supplemental posting in a conspicuous place to inform employees of the current minimum wage rate and their rights under the law; or if you do not have a physical business location, provide a copy of the notice to all employees that perform work in the unincorporated areas of L.A. County. DCBA will make available the notice that you are required to post in the languages needed.

- Maintain accurate and complete payroll records for each employee for a period of four years.

DCBA works with employees and employers to ensure that violations of the County’s minimum wage law are identified, addressed, and remedied in a timely and effective manner. If DCBA receives a complaint about your business, we will contact you to check your payroll records and interview you and your employees. DCBA has the authority to issue a citation for any findings of a violation. DCBA will discuss the investigation with you and allow you to respond to any complaints and correct the situation, if necessary. It is against the law for you to retaliate against an employee who:

- Requests to be paid the mandated minimum wage.

- Files a complaint about a potential minimum wage violation.

- Informs other people about their rights or a potential violation.

Department of Economic Opportunity

L.A. County’s new Department of Economic Opportunity is the home of the Office of Small Business. They can help small business owners get connected with contracting opportunities, pandemic recovery programs, and more ways to grow your business.

Understanding Misclassification in the Workplace

Misclassification happens when a worker is incorrectly classified as an independent contractor rather than an employee.

Clasificación Errónea de Trabajadores

La clasificación errónea ocurre cuando un trabajador es clasificado incorrectamente como un contratista independiente y no como un empleado.